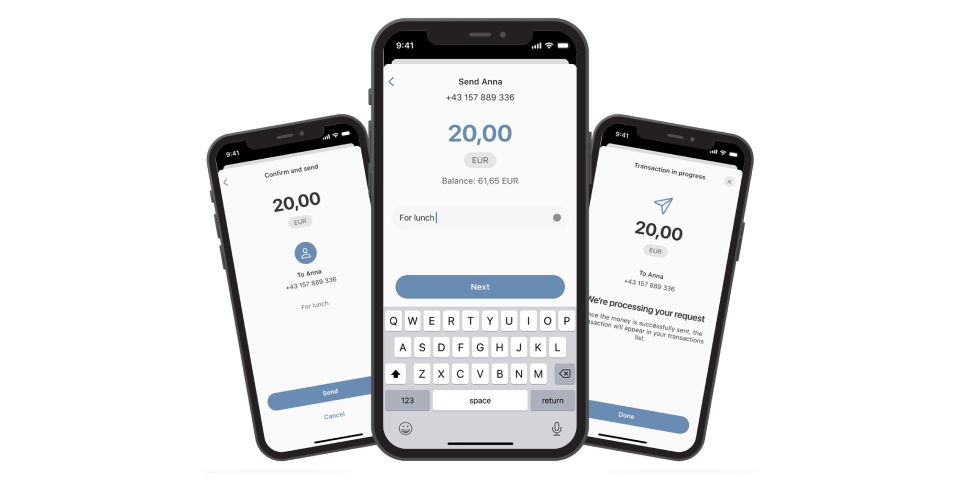

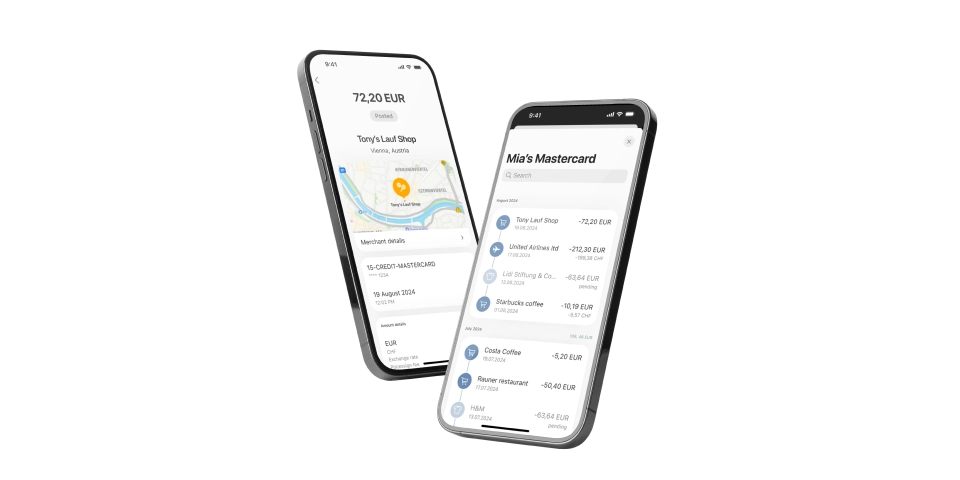

Increase your card revenues by offering your customers a state-of-the-art mobile payment experience and added value with G+D Netcetera's highly configurable, fully brandable, and secure mobile wallet.

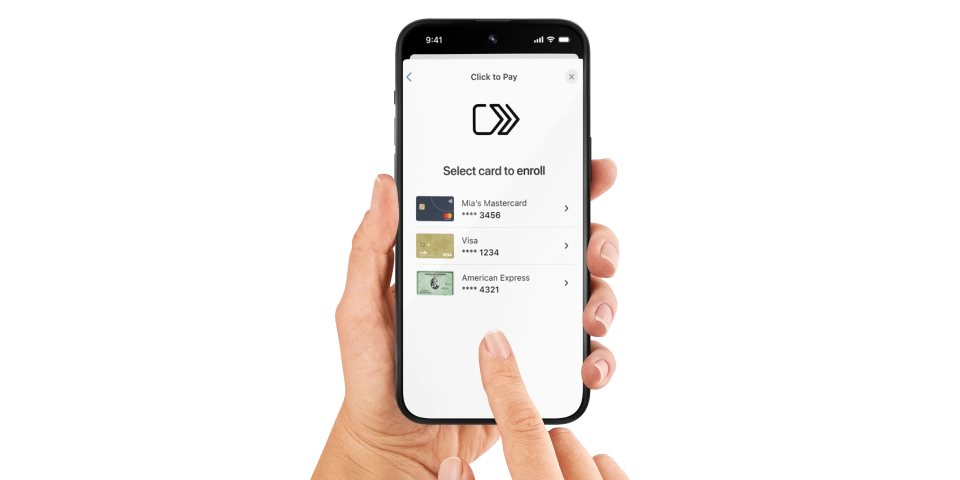

Our mobile wallet app is available both on Android and iOS and is compatible with global card schemes like Visa and Mastercard. With its toolbox approach, you can select exactly the modules and features that you need. No need to worry about whether your internal development capacities are sufficient to develop an app or if you should start a lengthy and costly project with a third-party provider to come up with a mobile solution from scratch: Our ready-made app enables fast time-to-market and with longstanding domain expertise, we are your reliable partner, taking care of the whole development process from UX design to go-live.