Click to Pay is an online checkout solution that allows consumers to confidently transact through an easy e-checkout, regardless of the payment card, digital channel, or device they use – by clicking just one button. Based on the EMV Secure Remote Commerce (SRC) global standard, Click to Pay works with all EMVCo partners (American Express, Discover, Mastercard, and Visa).

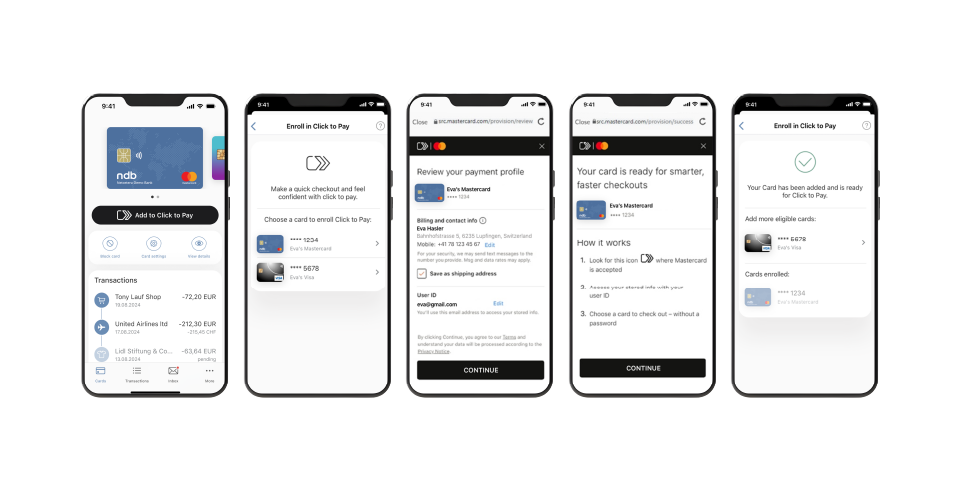

Push Provisioning enables card issuers to seamlessly connect their app with payment networks, allowing cardholders to securely enroll their cards for Click to Pay in seconds. This eliminates manual data entry, enhances convenience, and drives higher e-commerce adoption.